Controller of Budget launches investigations into suspect bank accounts in counties

Nyakang’o said her office is scrutinising the accounts to determine when they were opened, who manages them, and their intended purpose.

A probe has been launched into the rising number of suspected illegal bank accounts held by county governments. The Controller of Budget (CoB) is investigating why devolved units opened multiple accounts in commercial banks against regulations.

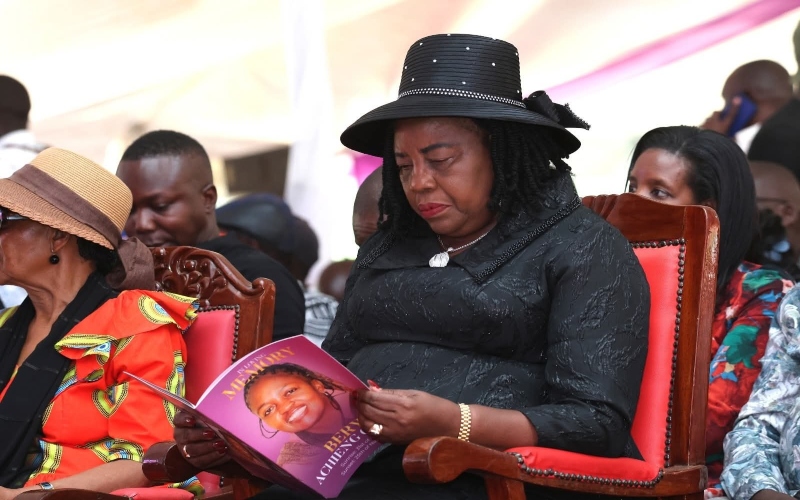

CoB Margaret Nyakang’o has accused counties of denying her access to bank statements, amid concerns that the accounts could be used to siphon taxpayers’ money.

More To Read

- Senate targets KEMSA in plan to turn devolved institutions into executive agencies

- Parliament seeks Controller of Budget control of Sh63 billion Housing Levy to curb misuse

- Controller of Budget urges faster adoption of e-GPS for public projects

- Revenue gaps, budget misalignments hurting service delivery, warns Auditor General

- Senate flags 24 State agencies still performing county functions

- Kenya intensifies fight against misuse of public funds through new leadership training

Nyakang’o has also revealed that her office is scrutinising the accounts to determine when they were opened, who manages them, and their intended purpose.

“We are reviewing those bank accounts to establish when they were established, who operates them, and what is their purpose; and we will bring you a report,” Nyakang’o told the Senate during a meeting in Naivasha.

Senators raised concerns over the high number of commercial bank accounts held by counties, fearing they may be conduits for financial mismanagement.

Nyakang’o criticised county governments for obstructing her oversight role by denying her access to their bank statements, making it difficult to track whether public funds are used appropriately.

“I sought to have viewing rights to the bank statements of the counties, which was denied. I have had to ask counties. I have had to bend my knees and beg for bank statements, but they still won’t give me their bank statements,” she said.

Although she did not name the counties blocking her access, her latest report shows that as of September 30, 2024, devolved units were operating 2,421 bank accounts — a sharp increase from the 2,000 accounts reported in the first nine months of the 2023-24 financial year.

She raised concerns that some of these accounts, opened during previous administrations, were still in use without the knowledge of new county officials.

“We were concerned that new bank accounts were being opened all the time and the signatories were not controlled,” she said.

“Indeed, when we checked some of the accounts, we found that they had been opened way back in 2013 during the previous administrations and that people in office were not aware that those banks existed. These were banks that were receiving revenue.”

Budgetary constraints

Due to budgetary constraints, Nyakang’o said her office is currently investigating 15 counties in the 2024-25 financial year, with the remaining counties set to be reviewed in subsequent years, depending on funding.

She lamented that her office was struggling with financial challenges after its budget was reduced from Sh1.6 billion to Sh702 million.

“I will be bringing to you an up-to-date report on these accounts, and then we can look at them and see where the rain started beating us,” she said.

The latest county expenditure report for the period ending September 30, 2024 revealed that Nakuru had the highest number of commercial bank accounts at 301, followed closely by Bungoma with 300. Baringo and Kiambu each had 292 accounts, while Machakos was operating 221. Elgeyo Marakwet had 155 accounts at the time of the review.

Public finance regulations stipulate that county government bank accounts must be maintained at the Central Bank of Kenya. However, counties have been found to violate the Public Finance Management (County Governments) Regulations, 2015, which restrict the opening of commercial bank accounts, except for imprest accounts for petty cash and revenue collection.

“The only exemption is for imprest bank accounts for petty cash and revenue collection bank accounts,” Nyakang’o said in her report covering spending from June to September 2024.

The latest report by the Ethics and Anti-Corruption Commission also shows that at least 26 counties are under investigation for corruption-related offences.

Top Stories Today